Press coverage: How to mange the soaring costs of private school fees – Financial Times, August 2022

Most parents send their children to private school because they want them to have the greatest possible start in life – to be happy, to develop their talents and social skills and to achieve the best exam results they can.

This month, with A-level results arriving, many parents who set their children on that journey 14 years ago will find out if the investment has fully paid off – at least in terms of exam results!

But what of those at the beginning of the road, contemplating the costs and sacrifices this route entails? You need to know what you are letting yourselves in for before handing the school bursar that first cheque.

How much do you need?

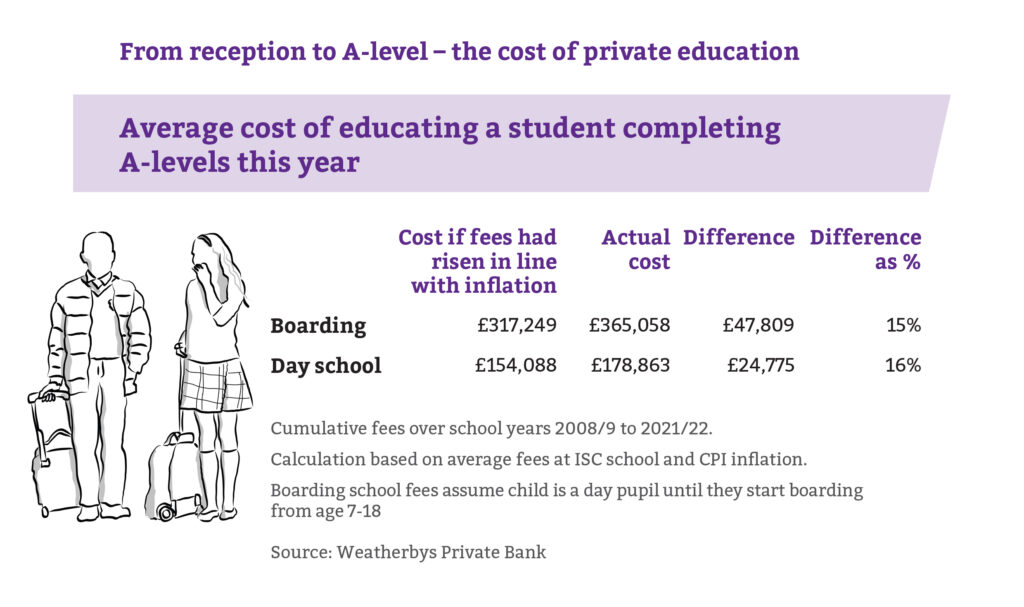

Taking historical data from the Independent Schools Council (ISC), we have calculated what it has cost to educate one child – let’s call her Lucy – waiting anxiously on this year’s A-level results. Lucy began private education as a day pupil in reception and stayed until the end of Year 13. The school charged average fees.

By our calculations, Lucy’s 14 years of education cost her parents around £179,000. Her cousin Edward boarded at school from the age of seven – his parents paid just over £365,000.

Our research shows that over the past 14 years school fees have risen more than 1.6 times the rate of general prices. Had Lucy’s parents looked at fees back in 2008, budgeting for them to rise in line with inflation, they would have underestimated by nearly £25,000. The parents of boarders would have found themselves nearer £48,000 short.

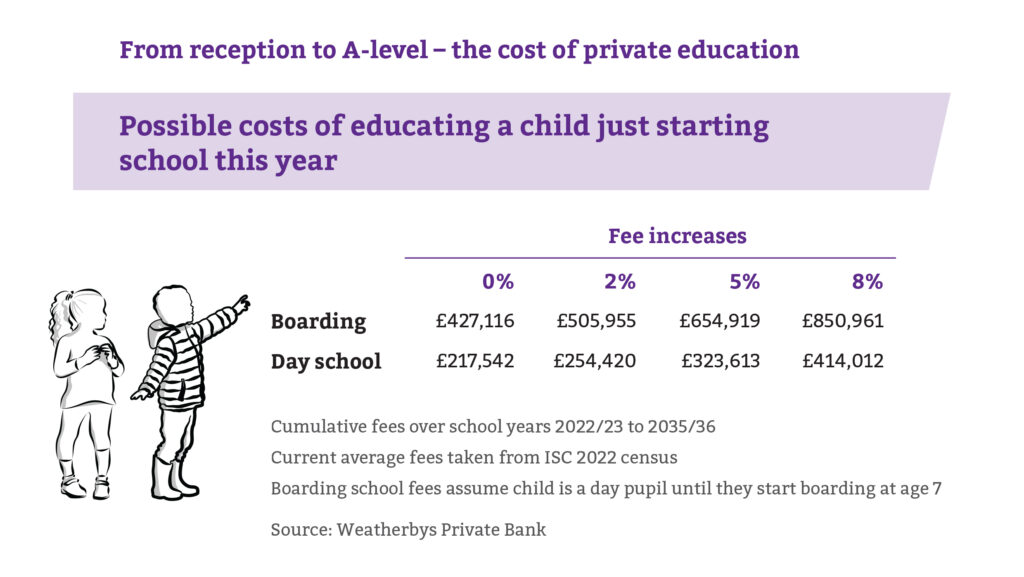

What might you expect if your child starts the journey this year? Based on this year’s fees and ignoring inflation and price rises a private education might cost on average around £218,000 for a day pupil and £427,000 for a boarder.

Factor in rising prices and the numbers shoot up dramatically, as our table shows. If fees rise 5% a year, for example, the costs jump to £323,613 and £654,919 respectively. Tuition is not the only expense. I tell families to factor in at least another 10% to cover additional costs, like uniform, sports equipment, music lessons and school trips.

How to reduce costs

There are a few ways to reduce costs. Find out if the children are eligible for bursaries or scholarships. Around one in three pupils receives help with their fees, often from the school itself. Bursaries tend to be means-tested and can be particularly generous. Nearly half of all pupils on means-tested bursaries have more than half of their fees remitted, and around one in seven pays no fees.

In addition, most independent secondary schools offer scholarships for pupils who are exceptional either academically or in music, sport, drama or art. These benefits – less likely to be means-tested – can typically mean a fee reduction of between 5% and 10%.

Investigate possible sibling discounts if you are thinking about enrolling a second child at the same school.

If you prepay a lump sum to cover all or part of your child’s education, then the school might offer a discount or hold fees. But beware – the Financial Services Compensation Scheme does not cover prepaid school fees. Your money could be at risk if the school runs into financial difficulties. And before committing, ask what would happen if your child was unhappy and wanted to leave after a few weeks. I have known this happen! How much would you get back?

Thinking ahead

There are now over 544,000 pupils at ISC member schools. Nearly 70,000 are boarding pupils. That is a lot of children. And it is a big commitment from their parents. Once you start in private education, it can be hard to take your children out of the system if your financial situation changes.

I have known people made redundant from well-paid jobs forced into this position, and it was upsetting for the whole family.

Private schooling is only affordable for many families with help from grandparents. I always remind clients that what they offer one grandchild they may want to offer all. And it might be some years before they know just how many grandchildren they are to be blessed with. This can be a very expensive act of generosity.

If you can, you may want to set aside the money up front. Grandparents may favour this approach, as it can help with inheritance tax (IHT) planning. If you have gifted a lump sum within three years of your death and your net estate exceeds the IHT allowances, then HM Revenue & Customs may demand back 40% of the gift in IHT. Die within three and seven years after the gift and the rate charged will taper downwards – dropping 8% each year. Gifting a large sum early can get the seven-year IHT clock ticking.

Smart investing of this money can help offset some of the pain of inflation. Children cannot own shares, except through a Junior ISA, but they do have the same tax allowances as an adult, including a personal tax allowance of £12,570 and a capital gains tax allowance of £12,300. Giving the money to the child’s parents to look after may cause tax issues for them, as any income and gains will be counted against their own tax allowances.

The simplest answer may be to set up a ‘bare trust’. Here the grandparent’s gift is registered through an account set up by the parents in their name but designated with the grandchild’s initials – essentially a ‘nominee account’. Any income or gains generated are treated as the grandchild’s for tax purposes. One potential drawback is that the grandchild takes control of any money left when they turn 18. The alternative is a discretionary trust. Here trustees you appoint retain control on the grandchild becoming an adult. There are significant legal and tax implications to discretionary trusts.

Whichever model you choose, once you make the gift you cannot demand the money back – even if you fall out with your grandchild or your own financial circumstances change.

If you do not give everything up front but pay regular monthly or termly fees, consider whether this is out of ‘excess income’. Such gifts are exempt from IHT. Set up a regular standing order and keep a record of income and gift payments to demonstrate to HM Revenue & Customs that this truly is surplus income. Your standard of living must be maintained, and you are not allowed to dip into your savings to pay fees.

Let’s hope this year’s A-level results bring just reward to all those who sat the exams – and to the parents and grandparents who supported them to this point, both financially and emotionally.

To download your copy of Spotlight on: school fees, please click the button below.